Free Payroll and Leave Management Software. Which means Net Salary 12.

Excel Template For Pcb Bonus Calculation Actpay Payroll

The quickest way to get your take-home pay.

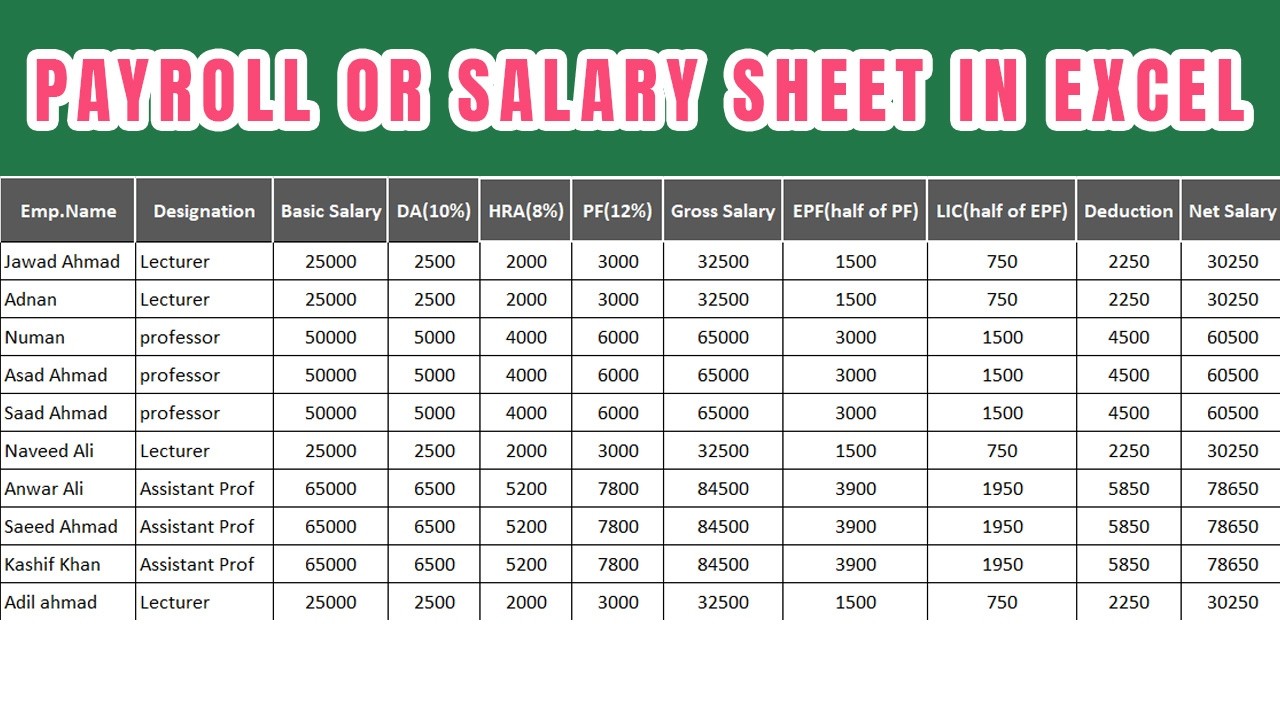

. PCB for 336747 775. Basic Allowance with EPF Allowance without EPF Monthly EPF limit Allowance not subject to PCB. Annual Salary Calculator Malaysia Annual Salary is the total amount of salary calculator earned by an employee on an annual basis before any Employee Deduction such as EPF Sosco EIS and Income Tax.

Regards Manoj Kumar 24th May 2016 From India Delhi Late Payment Charge Check Eligibility Check your eligibility. 10000 x 12 365 Rs 32875 33. 10 popular Payroll Questions from Actpay Customers.

Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here so you can have a better idea of. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. Input the Basic Salary Allowances Deductions and Overtime to calculate the gross salary.

The system is thus based on the taxpayers ability to pay. Basic salary 40 of gross salary 45000 X 40100. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

The PCB calculator 2021 in Actpay is approved by LHDN Malaysia and has 100 calculation accuracy verified repeatedly over the last 5 years. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. The calculator is designed to be used online with mobile desktop and tablet devices.

This salary calculator is applicable for monthly wages up to RM20000 and shows estimates only. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. Calculate your income tax in Malaysia salary deductions in Malaysia and compare salary after tax for income earned in Malaysia in the 2022 tax year using the Malaysia salary after tax calculators.

Malaysia Salary Calculator 2022. Salarycal is a useful Android device app that lets you compute your salary by also deducting your other monthly expenses such as loans and credit card bills. Choose the staff here to quickly go to staff detail in the Payslip Data screen.

Actpay Salary Calculator As Easy as 123 Payroll Malaysia. Export XLS All data can be exported to Excel for further processing reports. Sort is available for Employee No Calculation Date and Name.

The employees share of the EPF statutory contribution rate was reduced from 11 per cent to 9 per cent in 2021 affecting wages for the months of January to December 2021. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. However we usually total up employee annual salary after all the deduction made.

Generate payslips for FREE with PayrollPandas Payslip Generator. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. We would like to show you a description here but the site wont allow us.

Enter your basic monthly salary monthly bonus select your EPF percentage contribution and enable EIS and PBC. Salarycal Salary Calculator Malaysia. Enter your salary into the calculator above to find out how taxes in Malaysia affect your income.

PCB Calculator 2020 LHDN Approved. Payroll Reports and Payslip for Easy Payroll management. SOCSO for 370047 1875.

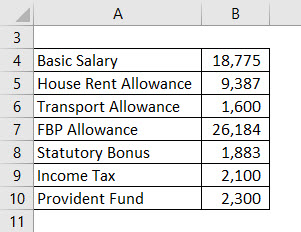

The gross salary and statutory deductions are then used to calculate the final Net Pay. Then per day salary will be. 38461538 x 3 11538461.

2500 1000 50047 333 300 336747. Value for Allowance without PCB 300. Just click on the table header to sort.

Also check your PCB EPF EIS and SOCSO calculations. The Free Payroll Software is Ad supported. 3 Good Reasons to switch from Excel Payroll to ActPay Malaysia.

PCB calculator Tax calculator EPF Payroll. Employer Employee Sub-Total - EPF Contribution. Basically it means Gross Salary 12.

Please note that PCB calculations are based on TABLE OF MONTHLY TAX. Rate this post Double-check. For example if the gross salary of an employee is 45000 Rs and basic salary percentage fixed by the company is 40 then the basic salary will be.

Etsi töitä jotka liittyvät hakusanaan Salary calculator malaysia excel tai palkkaa maailman suurimmalta makkinapaikalta jossa on yli 21 miljoonaa. In order to prepare basic salary calculation formula in Excel we need to know the gross salary and basic salary percentage fixed by the company. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

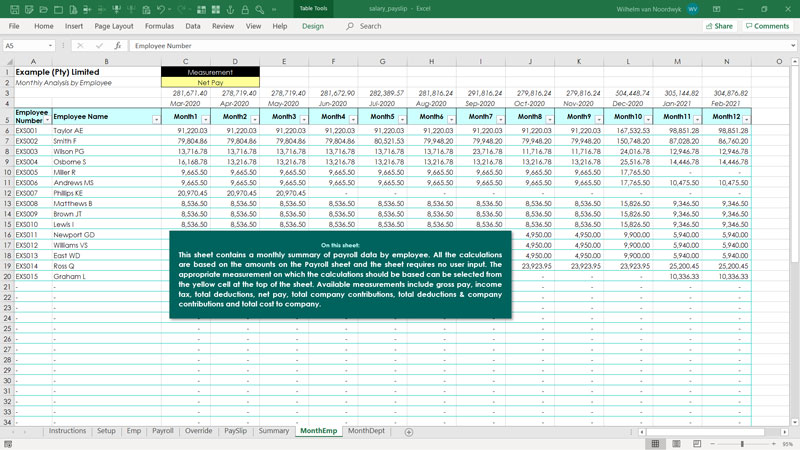

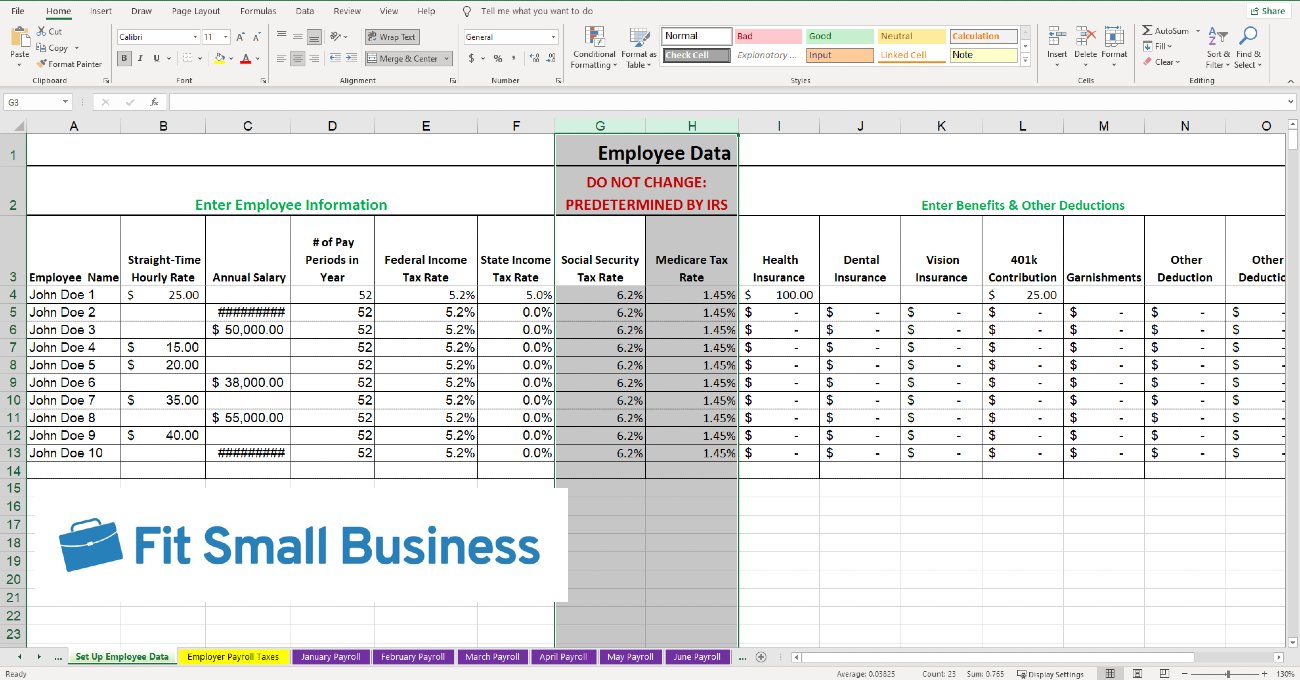

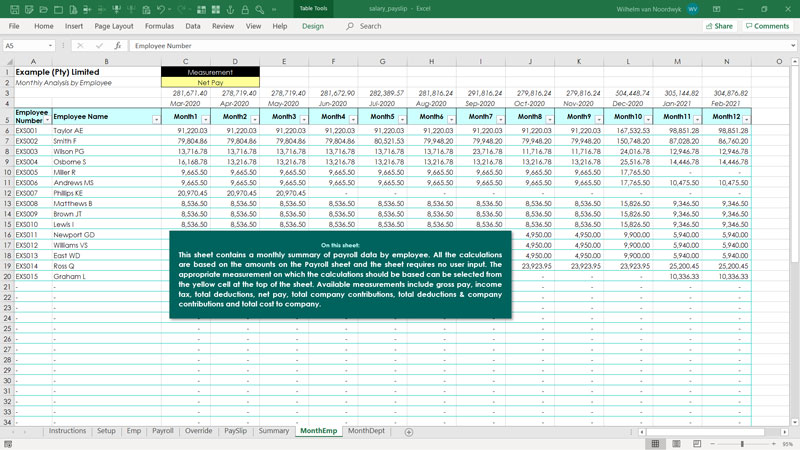

How To Do Payroll In Excel In 7 Steps Free Template

Excel Template For Pcb Bonus Calculation Actpay Payroll

How To Calculate Income Tax In Excel

How To Do Payroll In Excel In 7 Steps Free Template

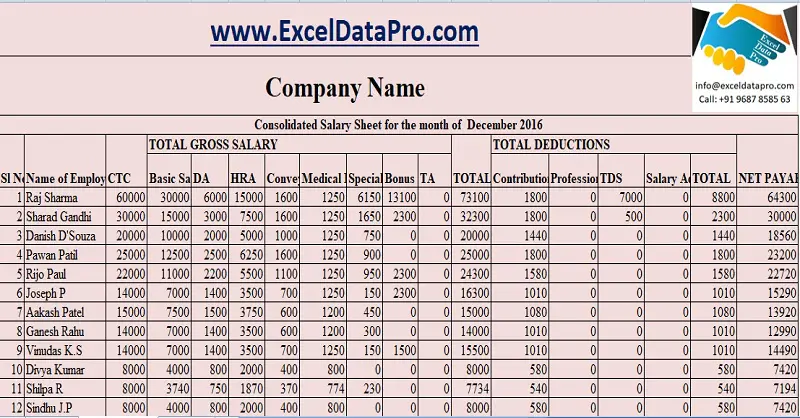

Excel Of Payroll Calculation Table Xls Wps Free Templates

Payroll Calculator Free Employee Payroll Template For Excel

Download Salary Sheet Excel Template Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

Excel Of Employee Payroll Calculator Xlsx Wps Free Templates

How To Calculate Income Tax In Excel

How To Do Payroll In Excel In 7 Steps Free Template

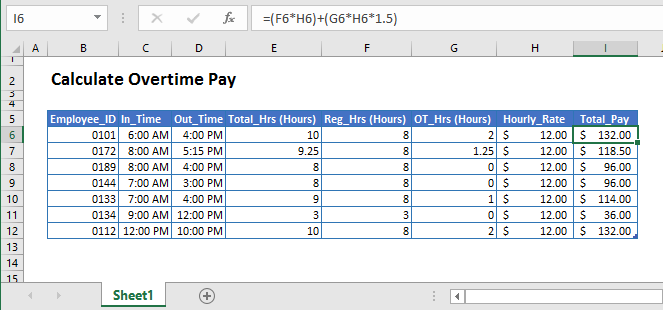

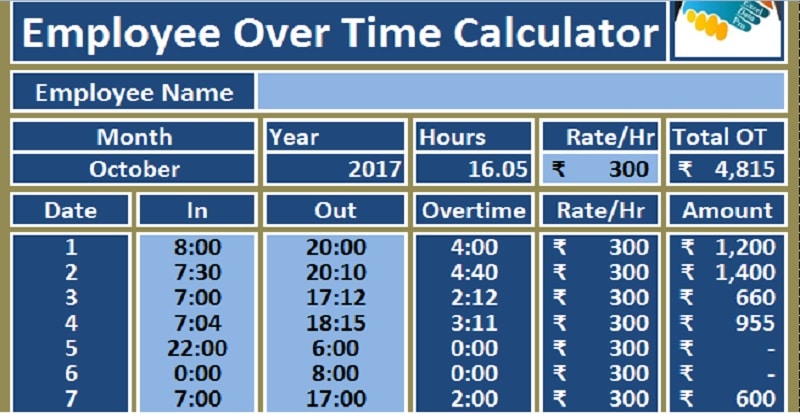

Calculate Overtime In Excel Google Sheets Automate Excel

Download Employee Overtime Calculator Excel Template Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

Basic Salary Excel Template Excel Skills

How To Make Salary Sheet Payroll Or Payslip In Excel 2016 Youtube

Excel Formula Basic Overtime Calculation Formula

How To Make Salary Sheet Payroll Or Payslip In Excel 2016 Youtube

Excel Of Employee Payroll Calculator Xlsx Wps Free Templates